All works

Landing the first client

Landing the first client

Refining the product strategy for AI insurtech SaaS product LifeScore for acquiring its first client

May 2021 - October 2022 | B2B SaaS, Data product | Insurtech | Pre-product-market fit

Background of the project

In 2021, LifeScore launched its v1.0 with 4 mortality risk predictive models for predicting life insurance underwriting decisions and medical recommendations. However, LifeScore v1.0 lacked market demand and could not secure any clients. LifeScore was in pressing demand to secure its first client and to reach product-market fit as the second step.

About LifeScore

The product I worked on

LifeScore is a predictive AI solution that empowers insurers to better quantify life and health risks. Powered by LifeScore Labs, a MassMutual wholly-owned insurtech arm, LifeScore was built with state-of-the-art machine learning technologies with 1M Asian local policy and claims data. LifeScore aimed at revolutionizing traditional insurance risk controls by providing insurers more accurate risk predictions based on actual claims data and alternative data.

About Haven Technologies Asia

Who did I work for?

Haven Technologies Asia is an insurtech SaaS startup wholly owned by Massachusetts Mutual Life Insurance Company, a Fortune 100 company. It offers life insurers in Asia Pacific region with cloud native, modularised, no code solutions backed by powerful data science models.

My role in this project

Product manager

I was the product manager for LifeScore, leading a scrum team of 9 consisting of data scientists, developers and quality assurance testers. My responsibilities included product requirement writing, backlog management, overseeing the data model development, product strategy, product roadmapping, user research, ux/ui design, partnership liaison and release management. The key objective after v1.0 release was to uncover why the product failed and what should be planned in v2.0 to secure the first client.

How did I approch?

LifeScore v1.0 was designed for underwriters to predict life insurance underwriting decisions. It was proven to be able to improve claim experience, i.e. lower the actual claim amount at the same risk level. But why was it not attracting any insurers to buy?

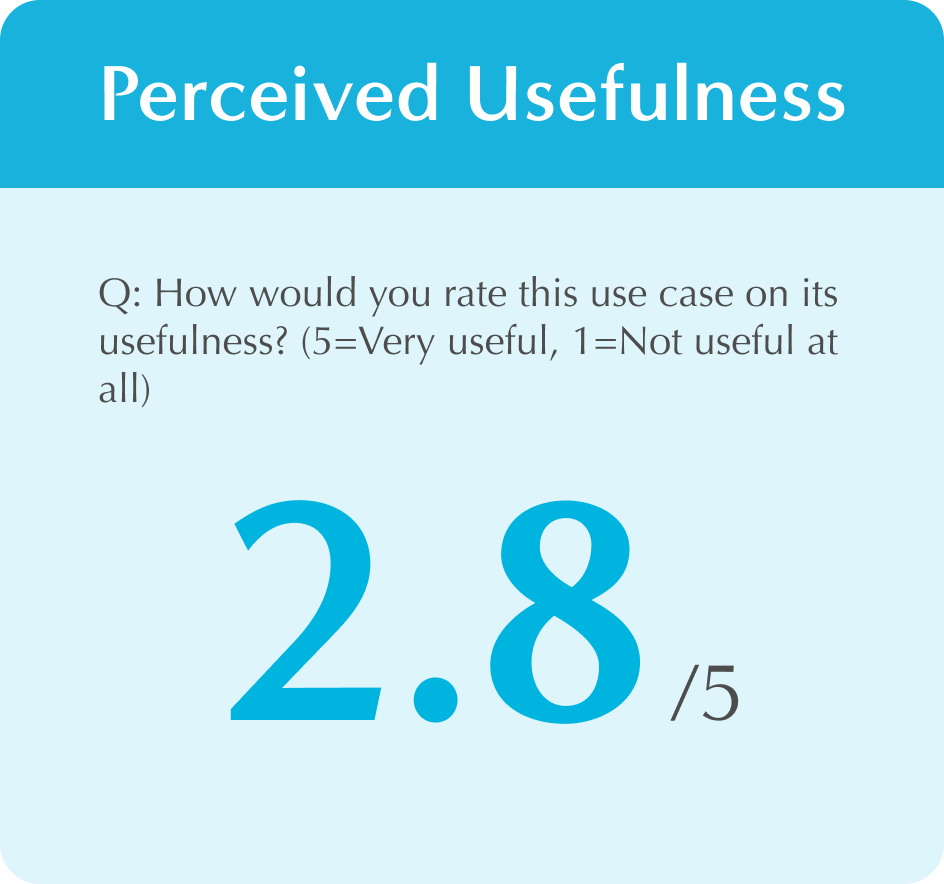

To find out the answers, 5 senior underwriting executives from both large-scale and small-to-medium-scale insurers were recruited for user interviews and concept testing.

The underwriters rated the perceived usefulness at 2.8/5, proving a general unattractiveness of the product to underwriters.

Why was LifeScore unattractive to underwriters?

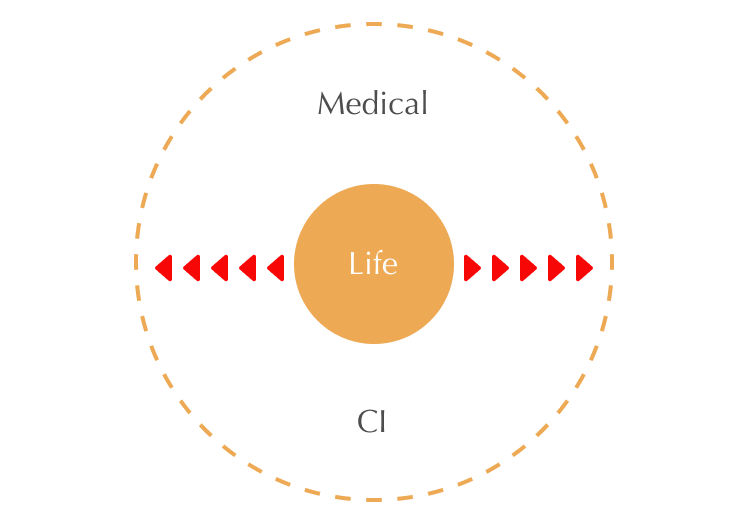

Limited to life insurance products only

Underwriters saw limited usage of LifeScore as it covered life insurance risks only. They wished LifeScore could be applied to medical and critical illness products.

Lack of understanding and confidence on LifeScore

Underwriters did not understand how LifeScore works and what values could a predictive AI model brings. There were also concerns over accuracy, effectiveness and potential discrepancy from traditional underwriting decisions.

Contradictory to current underwriting practice

Underwriters were hesitated about adopting LifeScore as they were worried that the decision predictions from LifeScore would contradict the decisions according to reinsurers’ guidelines. They also had no incentive to improve claim experience as underwriters.

Summary from Report on Concept Testing with HK Underwriters.

Read the full report

Despite the negative feedbacks, the research pointed to possible direction for LifeScore to consider:

Extend coverage

Extend product coverage to medical and CI products.

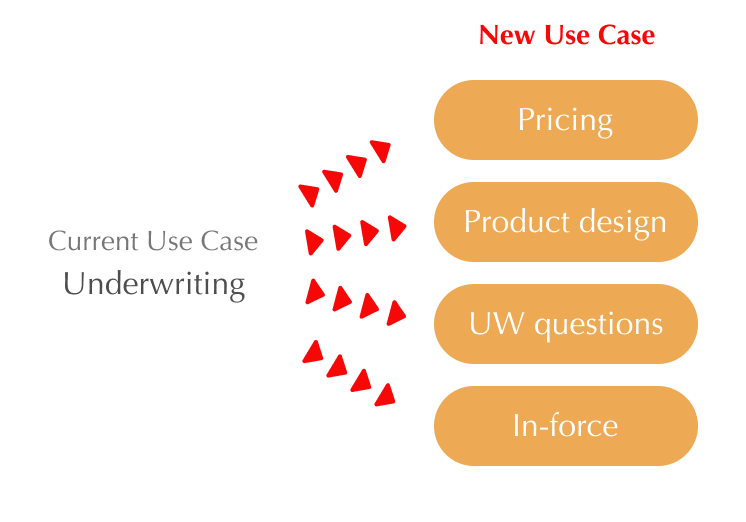

New use cases

Explore new use cases in product pricing, underwriting question design, in-force customer risk control, targeting at product and actuary executives instead of underwriting executives.

Partnerships

Seek partnerships with or approvals from reinsurers to push for a change in the underwriting practice.

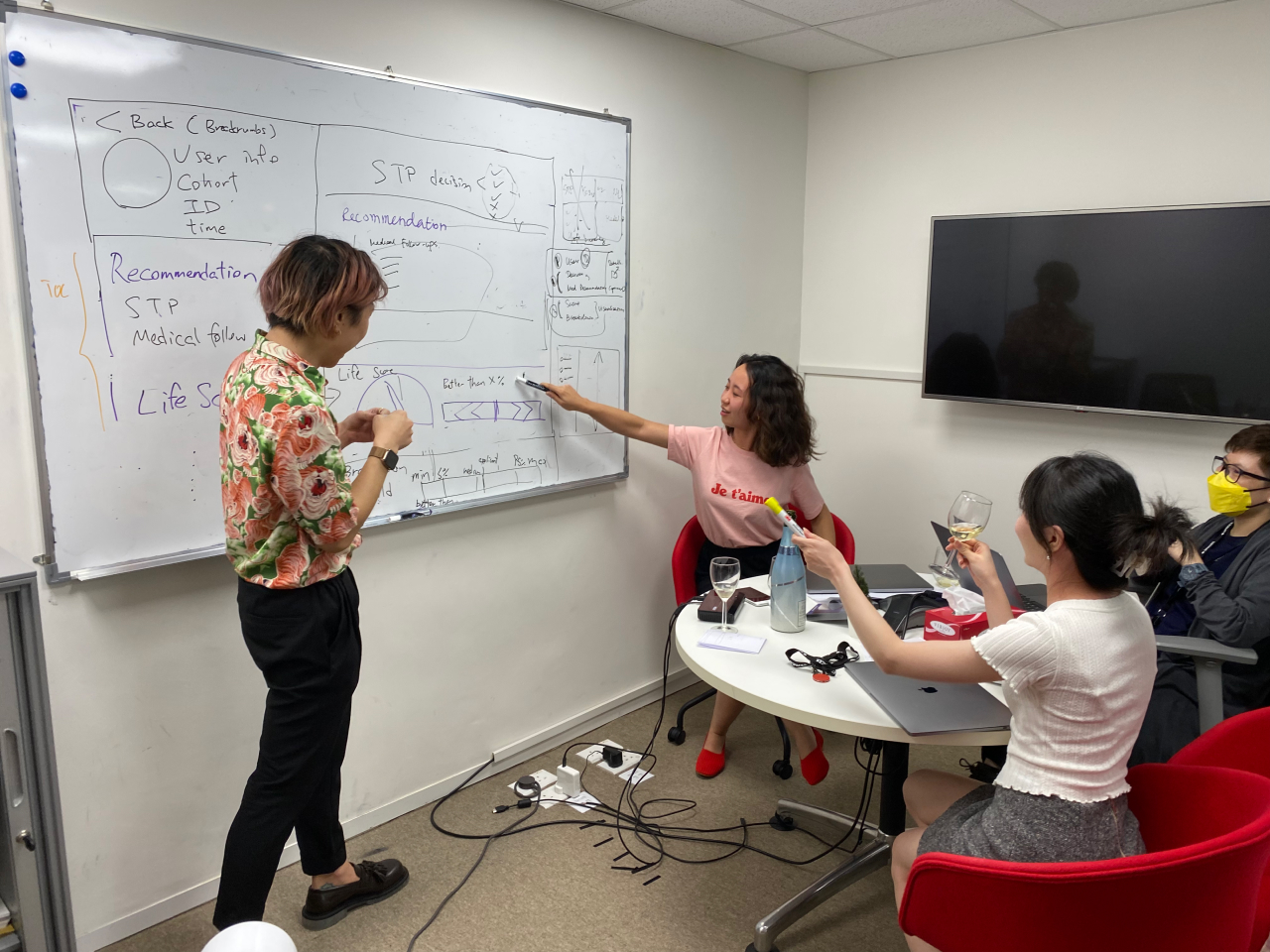

Based on the research result, an ideation workshop was ran between the scrum team and the sales team to lock on the key direction for LifeScore v2.0.

The team agreed that the focus of LifeScore should shift from mortality risk (life insurance) to morbidity risk (medical insurance).

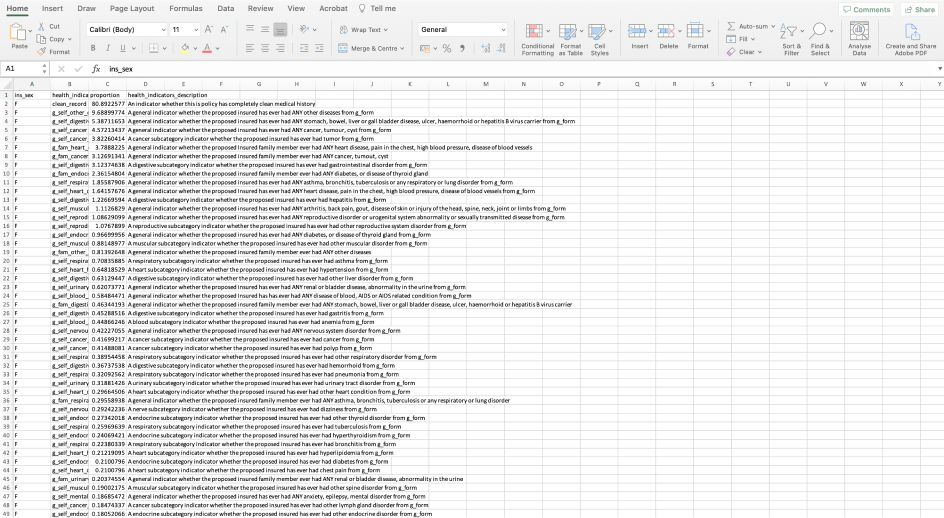

The full list of application data and claims data, digitized from paper forms.

A data asset evaluation was undertaken to make sure a new model for predicting medical insurance decisions is feasible.

A few new use cases were also brought forward for further validation including loading amount prediction, excluded condition prediction, loss ratio prediction and chronic disease incidence prediction.

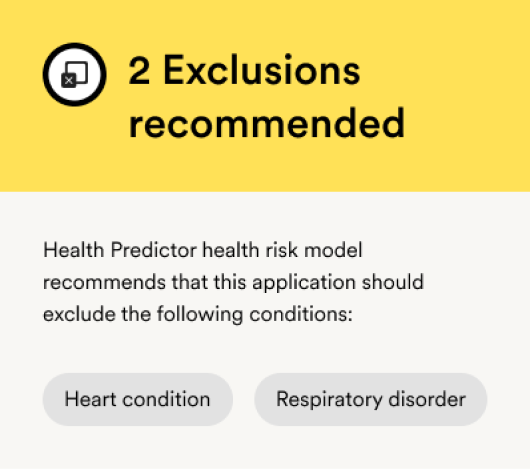

Use case: Predict excluded conditions for exclusion class.

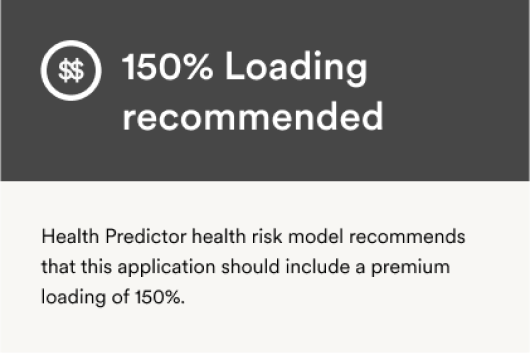

Use case: Predict loading amount for loading class.

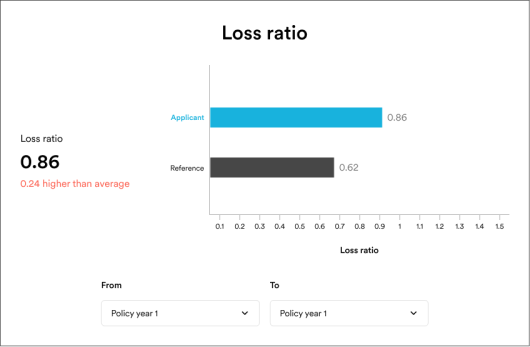

Use case: Predict loss ratio in a specific period.

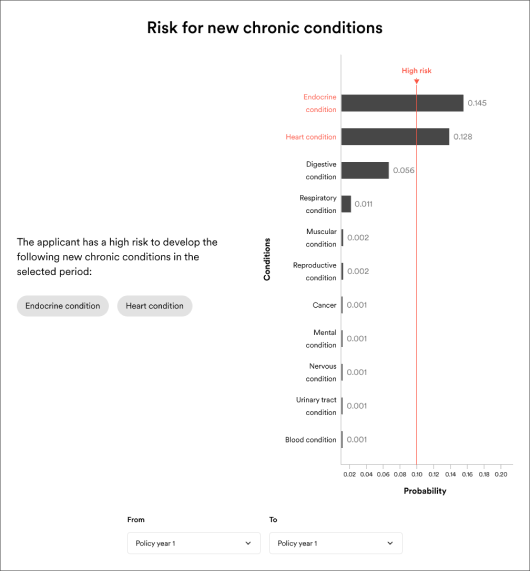

Use case: Predict the probability of developing a new chronic condition in a specific period.

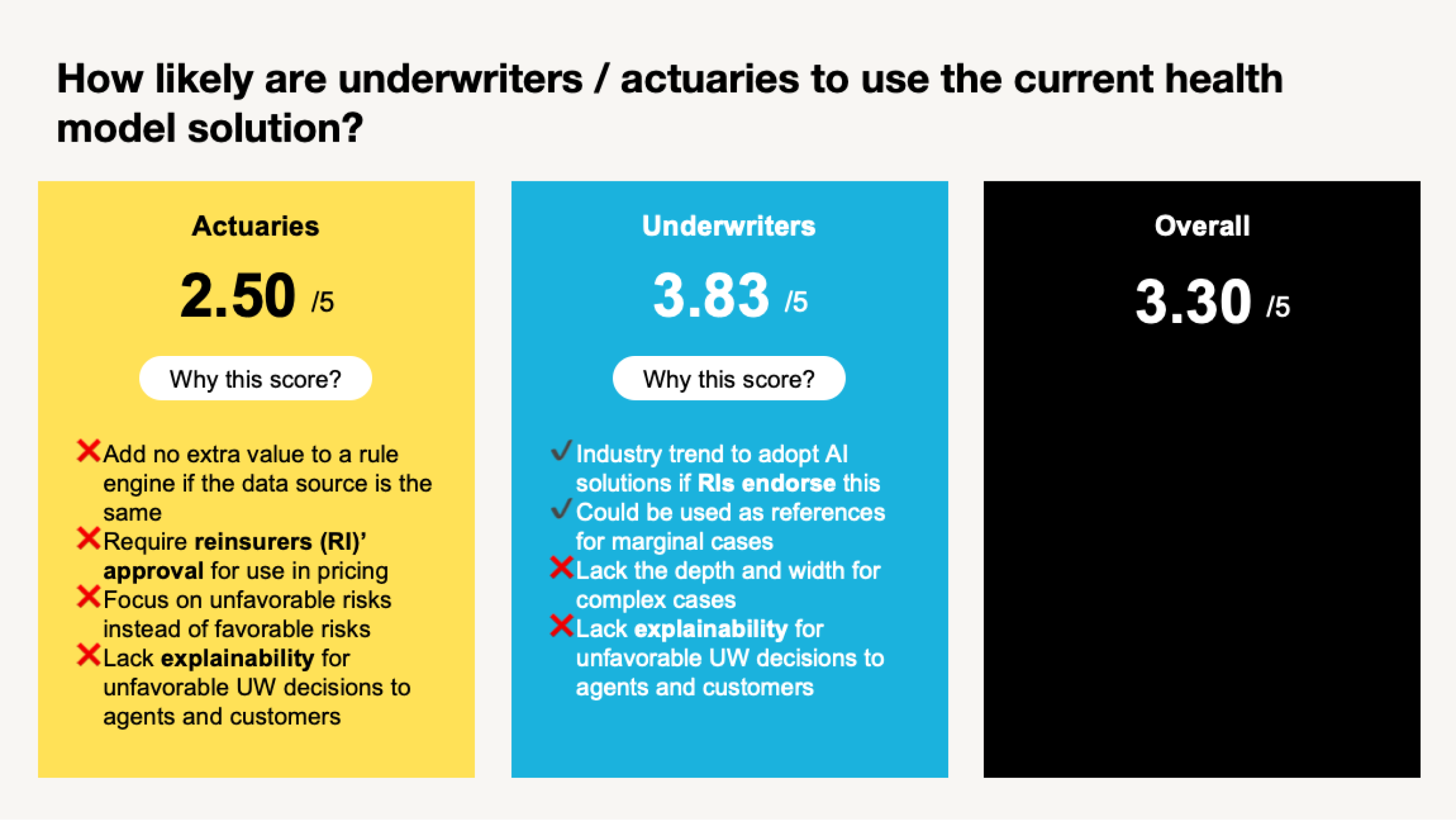

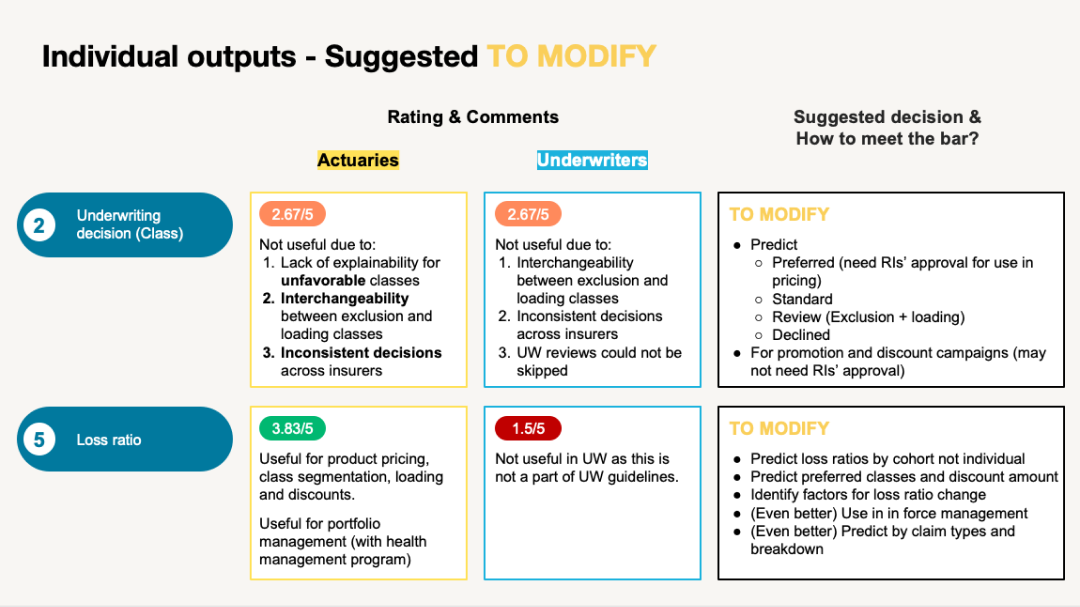

Meanwhile, a new round of concept testing was carried out to test the desirability of the health model itself and 7 proposed use cases of the model. 3 senior actuaries and 3 senior underwriters were recruited this time for the test.

An abstract from Report: LifeScore Health Model Concept Test Report.

The test did show a high approval of the model from underwriters (likelihood to adopt LifeScore: 3.83 over 5) but not actuaries (2.50 over 5).

Why was LifeScore unattractive to actuaries?

No extra value compared to a rule engine

Actuaries found no extra value could be offered by LifeScore since both LifeScore and rule engines (current underwriting system) shared the same data input of underwriting questions.

Reinsurers’ approval for use in pricing needed

New pricing and product design initiated by LifeScore requires reinsurers’ approval in scenarios where reinsurers are hired to insure the product.

Focus on unfavorable risks instead of favorable risks

The tested use cases focus on the prediction of unfavorable risks and class decisions such as loading amount and excluded conditions. Actuaries pointed out that favorable predictions yield a much higher value to the industry as there is no existing practice in the market to identify this group and favorable decisions are also much easier to be accepted by the distribution sector.

Summary from Report: LifeScore Health Model Concept Test Report.

Read the full report

The test result raised the alarm for us on how unattractive LifeScore was for our target clients. However, on the positive side, it highlighted LifeScore’s gaps from achieving product-market fit.

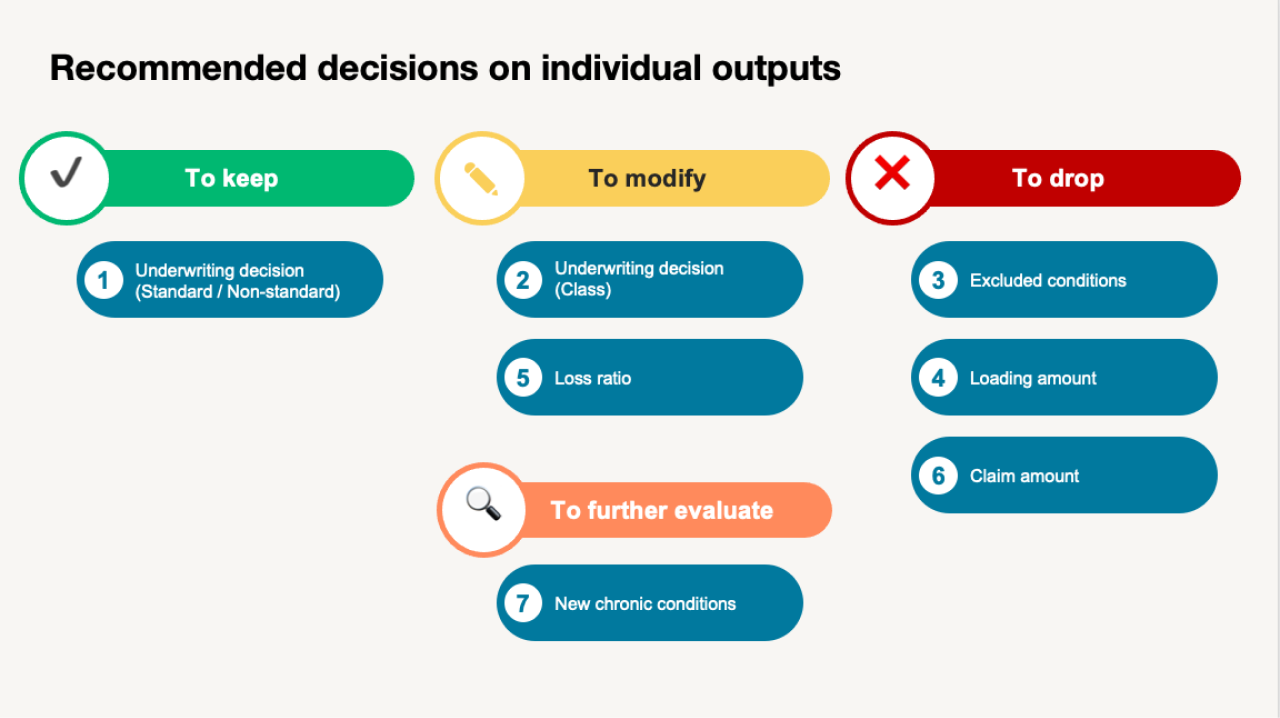

Recommendations on the proposed model outputs based on the result from Report: LifeScore Health Model Concept Test Report.

Two gaps to overcome

Fill the demand gap for favorable risk and decision predictions

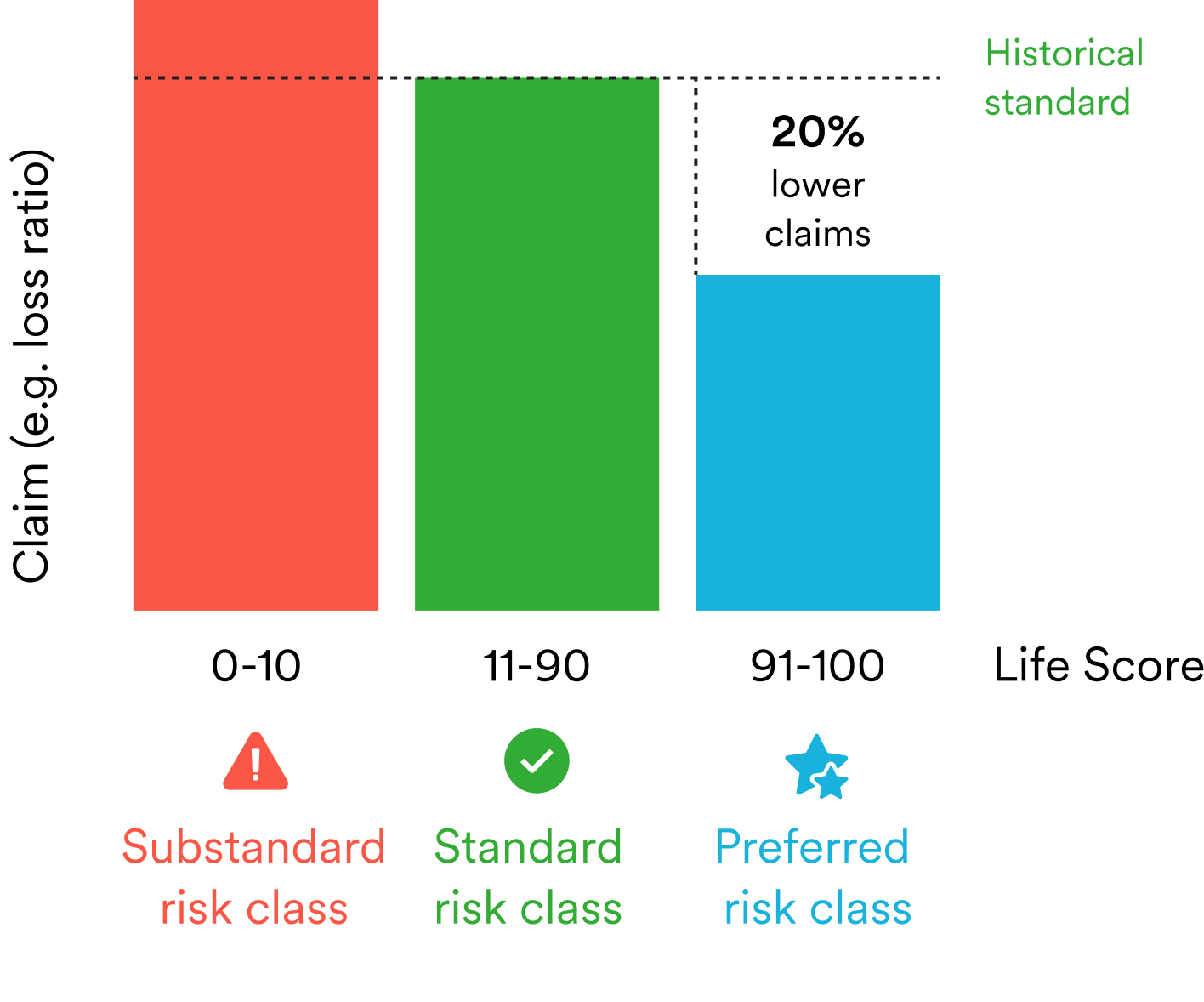

After a quick technical evaluation with the data scientists, a decision was made to add the preferred risk class prediction function to LifeScore v2.0. This addition allows insurers to identify a preferred risk class with a 20%-lower loss ratio.

Get buy-ins from reinsurers

Our team reached out to 4 reinsurers in 2022. By the end of 2022, 1 reinsurer agreed to become a partner with LifeScore followed with an integration to their underwriting system.

Recommendations on how to improve the proposed outputs to meet desirability standard.

What happened in the model development process?

Based on the required model outputs, data scientists would build up to 100 different models using different input combinations and modelling methods. A key role for me here was to evaluate the performance of the model in terms of class differentiation by loss ratio, accuracy, agreement rate.

How did we validate new product ideas?

Scope evaluation was carried out for any new product ideas to assess their desirability, feasibility and viability.

To pass the desirability test, a new product idea must pass the following requirements:

- Propensity-to-buy score > 3.8 in concept testing (>= 3 users); OR

- More than 80% of users in concept testing recommend this solution; OR

- A client has requested this solution for immediate collaboration

This framework ensured that the most promising product idea would be prioritized and internal conflicts were minimized among the team and stakeholders.

The outcome

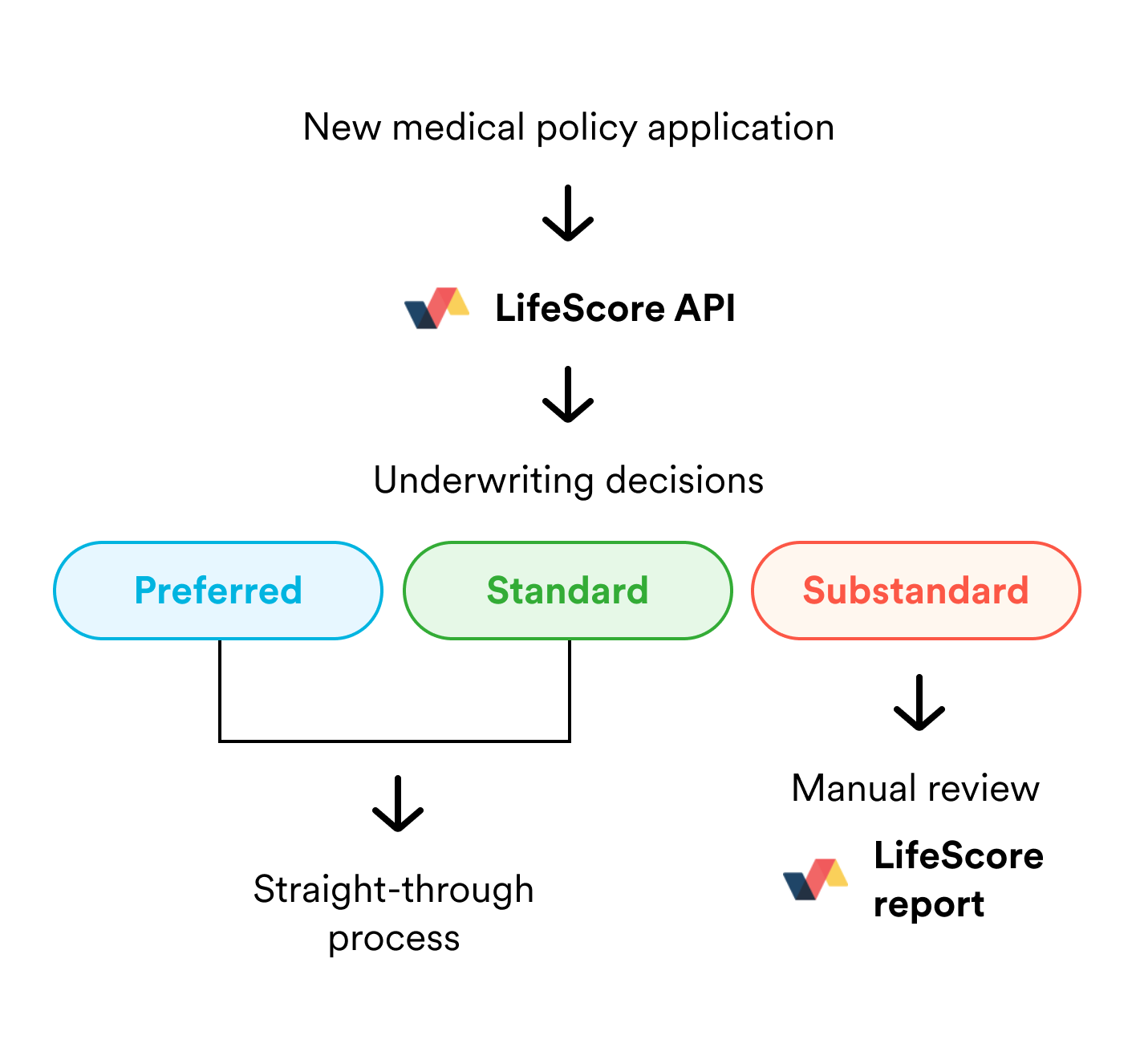

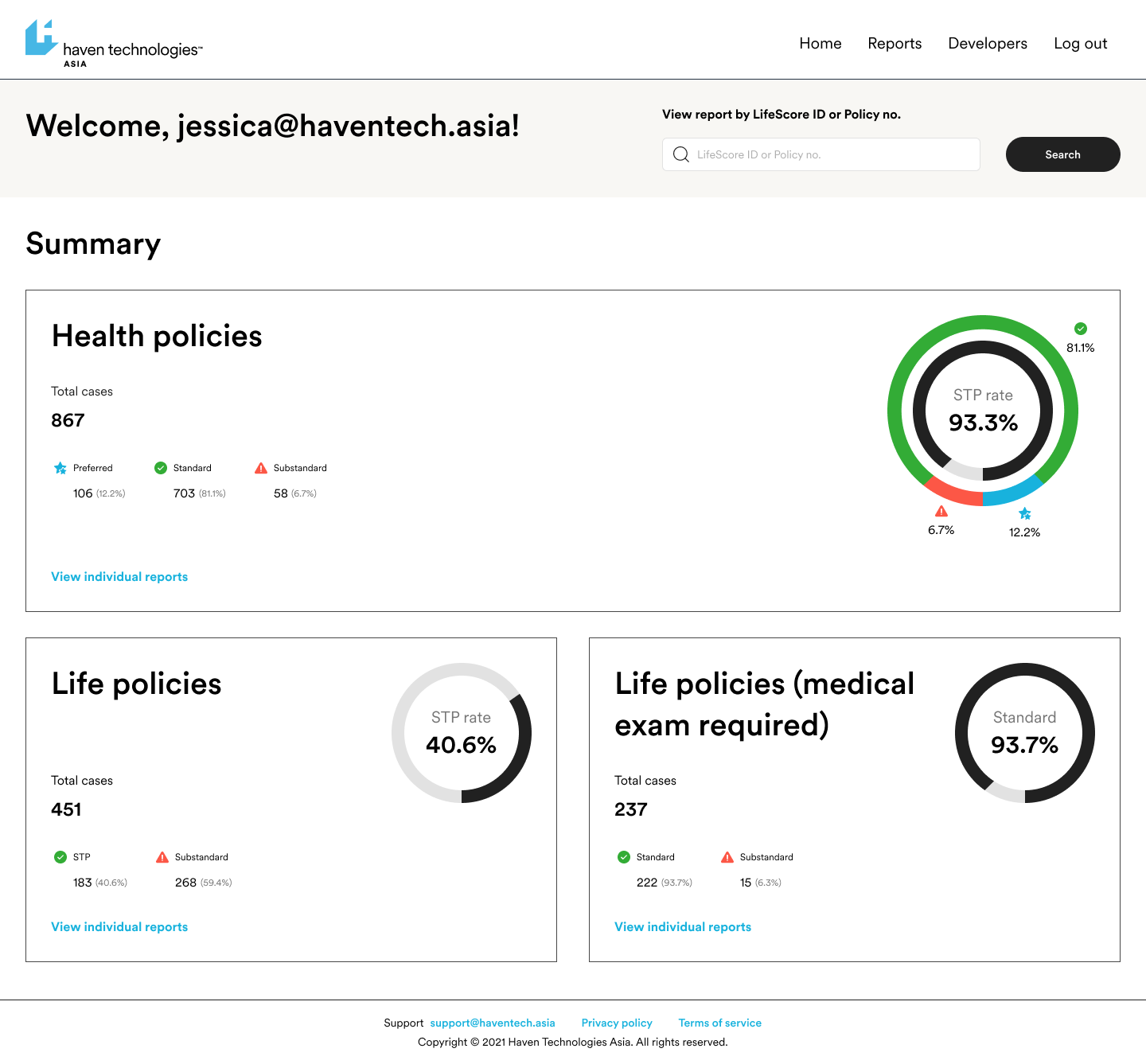

LifeScore v2.0 was officially released on July 21, 2022. The new version added the Health model which supports the prediction of risk class including a preferred risk class for medical insurance customers.

AI underwriting use case

LifeScore API was now able to make accurate underwriting recommendations for STP decisions, risk classes for medical insurance products based on claim experience.

Business benefits

Higher underwriting STP rate

Better claim experience

Improve operational efficiency

AI-powered pricing use case

LifeScore API was able to differentiate a preferred risk class with up to 20% lower loss ratio than the standard risk class. This could be used for pricing for medical insurance products.

Business benefits

Up to 20% lower claims for preferred class

More competitive pricing strategies

Product innovation

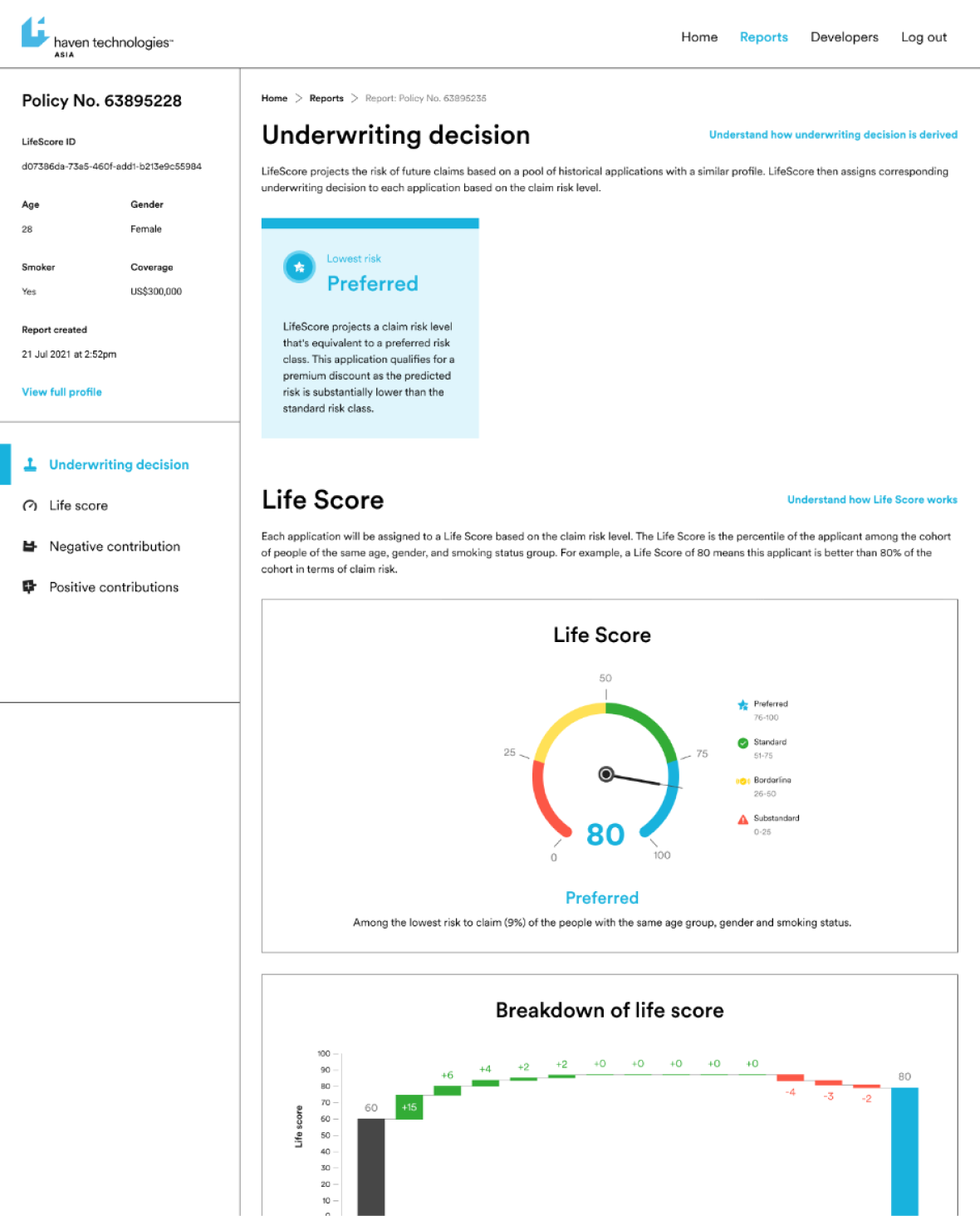

LifeScore dashboard with the addition of the health model.

LifeScore report for individual applicant.

What’s unique about this product?

This is the first product in Asia market to be able to predict a preferred risk class with a 20% lower loss ratio. This allows insurers and actuaries to offer extra discount for preferred risk class customers.

LifeScore's promotional video

First client

LifeScore landed the first client!!!

The debut of LifeScore v2.0 garnered new attention and traction for LifeScore. In August 2022, LifeScore landed its first client, an international insurers with presence across Asia. This marked a key milestone for LifeScore.

What’s next?

Although the release of LifeScore v2.0 brought us the first client, there was still a large gap between our product position and product-market fit. A few initiative were kickstarted based on previous research and client feedbacks.

Alternative data incorporation

An in-depth research on the source, cost of acquisition and probable predictions was carried out to push forward this initiative. Federated learning and transfer learning were two key areas for our consideration.

In-force risk checker

LifeScore v2.1, which was launched in October 2022 featured a batch processor which allowed insurers to upload policy holders in a batch for quick risk checking.

Free trial

Free Trial was planned as a key initiative in 2023 roadmap to allow clients to try LifeScore. The idea was to kickstart the conversion funnel to gather more client feedback.

Underwriting question model simulator

LifeScore v3.0, which launched a alpha version in November 2022, featured the model simulator for client to simulate the performance of different underwriting question sets.

Reinsurer partnership

Reinsurer partnership was identified as a key to clients’ adoption. After multiple rounds of negotiation, we sought to form a partnership with a key reinsurer where our product would be integrated to their underwriting platform.

Comorbidity prediction

Comorbidity prediction was identified as a known gap in current underwriting rule engines. However, the initiative was dropped due to low assessed value and high investment cost.